Future of Cryptocurrency in India: Should You Invest?

Cryptocurrency, the 21st-century asset class, is the buzzword of the investment market now. The understanding of cryptocurrency is more as something that can provide good returns over time. Thus, it is gradually becoming an investment venture. However, the technicalities behind this currency are deep. Virtual currency is a digital asset that has no physical form like that of fiat money. Starting with Bitcoin, now there are thousands of cryptocurrencies that may be or may not be based on Bitcoin.

Cryptos are based on blockchain methodology and use a decentralized network of users, where members can authorize and validate each transaction in the blockchain. These currencies are not controlled by any central authority like central banks or Government bodies. They can create a free and independent economy as they are open-source, consensus-based, and offer complete ownership. Well, let’s not go to the technical aspect and push it to another discussion. Words like “smart-contract”, “mining”, “decentralized application”, and all, sound more like jargon when we are interested in the investment and “money” side of the coin.

The Cryptocurrency Buzz

As of 2021, the Reserve Bank of India is set to roll out its digital currency, the CBDC, Central Bank Digital Currency, the digital version of the Indian Rupee. It is different from what cryptocurrency is. But, it is a clear indication of how the Indian government is prioritizing virtual currency as the need of the hour. However, the present stance is an after-effect or an unfolding of the well-planned strategy since the 2018 blow by the RBI circular that banned cryptocurrency trading in India. It was only the Supreme Court that came as the savior in 2020 when it declared the ban unconstitutional since cryptocurrency trading is a legitimate way to make money. Thanks to the Internet and Mobile Association of India, who had the guts to challenge RBI. Now, it’s a popular business for the public in India to invest and earn money, well, at their own risk, as any other business for profit.

Even if RBI seems to act tough, none can deny the lenience of the tech-savvy Indian government towards the aspect of the uberization of currency. The CDBC could be the first step toward a bright future where India could have its own cryptocurrency. It’s only a matter of time, for future research and development, which, in return, will increase credibility and decrease the risk associated with cryptocurrency investment.

So, what’s going on?

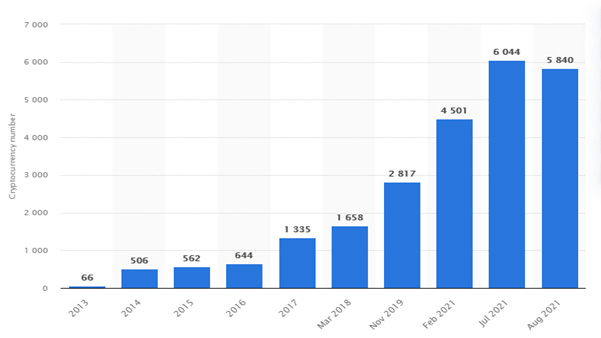

Platforms like moneycontrol.com and NDTV Gadgets, are among the big players in the information market. Theses portal currently provides the gateway to trade in more than 30 different cryptocurrencies, starting for the bosses like Bitcoin and Etherium, to trendmakers like NEM, Gas, Dogecoin, etc. There are more than 5500 cryptocurrencies around the world and the number is increasing every week. The strong market force created by demand is the engine behind the growing numbers. It means investors are bullish when it comes to cryptocurrency.

Figure 1: Number of cryptocurrencies from April 2013 to August 2021: Source: Statista

In India, the cryptocurrency market has been exploding. There is no credible record of exactly how many cryptocurrency exchanges are operating in India. Still, cryptocurrencies’ transactions in India soared 30 percent during the past year, 2020 to 2021. Currently, about 10 million Indians are using cryptocurrency in India. This figure would be 100 million worldwide. As per Chainalysis’ Global Crypto Adoption Index 2021, the worldwide adoption of cryptocurrency between mid-2020 to 2021 grew by a mammoth 880%. Whereas India is the home to the second-largest group of Cryptocurrency investors, Vietnamese have surpassed the Indians. As of now, more than 1.5 crore Indians are holding cryptocurrency worth over rupees 1500 crore.

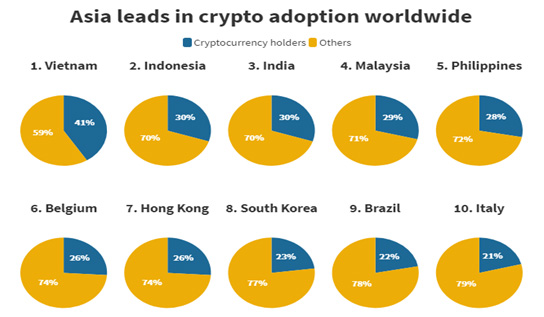

Figure 2: Country-wise adoption of cryptocurrency as of 2021: Source: Finder Report

Asian nations are now the forerunner in the cryptocurrency market, with India among the top. While in nations like India, Malaysia, Indonesia more than 25% of respondents in the survey by Finder Reports own cryptocurrencies, the figures are significantly low in European nations like Italy with less than 10 percent of respondents owning such assets. China, as well, has been hard on cracking down the market through tough government regulations. The dismaying trend of the American and European early birds in this market is also due to recent government policies. Still, such nations do recognize the currency, especially Bitcoin, as a means to investment and business.

What makes cryptos valuable?

A look at the price chart of Bitcoin(BTC) over time confirms that it has been vigorous for a long time and showing no signs of decline. With futuristic giants like Tesla supporting this crypto, it is bound to reach the mainstream economy with general adoption in near future. Although BTC passed through several bubbles in the past, it is still the most coveted asset in the currency market. The price of primary cryptos like BTC, are mostly driven by demand and their scarcity is the reason behind their high demand. What makes cryptocurrencies scarce? It is because it is not possible to print, issue, authorize or circulate them like banknotes which are printable and supplied as per the government. Cryptos are limited because, with the production of each unit or each transaction, it becomes harder to generate the next unit. As the algorithm generating the coin becomes tougher, it requires more power to run a comparatively tougher algorithm than the previous one.

Therefore, a point would reach when it could not be possible or just too tough to mine and generate the next bitcoin or a crypto coin. Bitcoin has already reached 89 percent of its total supply capacity in April 2021. By 2040, there could be no new bitcoin because even the most powerful machine would not be enough to solve the algorithm. The fact that mining a bitcoin consumes an amount of energy equal to that of a small country explains its present value of around 30,000 USD.

Cryptocurrency: The New Gold

Bitcoin gained the moniker of “new gold” due to its increasing scarcity. If the rarity of both Gold and Bitcoin are considered, they become similar. Arguments of gold becoming less attractive in comparison to cryptocurrencies like Bitcoin and Dogecoin have valid reasons. As digitization gains more traction, digital assets and currency are making more sense as a real transactional medium of exchange rather than gold. While gold is related to fiat or printable currency, cryptocurrency is based on computing power and energy. The supply of gold determines the USD, which determines other currencies. Currency based on gold is dependent on geopolitical boundaries, while cryptos are purely based on power computation power irrespective of national boundaries. These reasons have made cryptocurrencies a better option to invest in than gold.

However, gold ranks higher in terms of legality, transparency, and safety, unlike cryptocurrency. Also, gold offers better accessibility to common masses rather than cryptos, convoluted with high-end technology. Still, bitcoin has become the major contender of investments as opposed to gold in current times. As governments across the globe bend over the legality and controlled distribution of digital currency, cryptos are bound to become more secure in the future. Therefore, both gold and cryptocurrencies have pros and cons, and investments solely depend on the analysis and understanding of the investors. There are many instances when investments in cryptocurrencies yielded better returns than gold.

Should you invest?

The fervor across the world as well as in India indicates that cryptocurrency trading is a promising business anyways. However, finding the depth of this promise requires a good analysis. Cryptocurrency is regarded as the most important asset class of the 21st century. Keeping the circumstances of public investments in view, the only way left for India is to establish a legitimate mechanism to handle the affairs of this asset. As expected, the Parliament is prepared to table the new Cryptocurrency bill in the coming winter session. Since the multidimensional usage of cryptocurrency is too important to ignore, the Blockchain and Crypto Asset Council of India will set up a board that would function as a self-regulatory body. Among other activities, it is expected to liaison with the regulatory and supervisory authorities as RBI and Financial Intelligence Unit to flag suspicious transactions.

India is keen to adopt a cryptocurrency, but with enough caution to safeguard investors and possible misuse of this high-end asset. Indian banks are now gradually beginning to ease their restrictions in Bitcoin transactions. Irrespective of the decision of the government, the avenues to invest in cryptocurrency are always open. Investment is purely about business and profit. Knowledge of the market and a proper understanding of what you are backing on is crucial. Even stakes in gold cannot ensure a high return without adequate market awareness. When it comes to cryptocurrency, it is necessary to understand the technology, market, and especially, the mechanism driving the currency in the market. When you are equipped with proper information, and the acumen to act in precise timing nothing stops you from winning. It’s particularly true in the case of cryptocurrency. Happy investment!