NPS Pension Calculator - Calculate Pension Under NPS Scheme

National Pension System (NPS) is a PFRDA (Pension Fund Regulatory and Development Authority) regulated comprehensive pension scheme for Indian residents. The market-linked pension scheme offers the creation of a retirement corpus to buy an annuity scheme at the age of 60. The subscribers under the NPS scheme need to contribute to their accounts till the age of 60. During retirement, at the age of 60, a maximum of 60% of the accumulated corpus is allowed to withdraw as a lump sum, and the remaining funds will be applicable for buying an annuity plan. An annuity scheme is a fixed-income plan against a one-time investment that enables a periodic cash inflow with a fixed rate of interest for a person's entire life. The NPS calculator helps to estimate the return and expected pension on the maturity of an NPS account.

Also Read: How to set up SIP for NPS using D-Remit service

What is the NPS Pension Calculator

Finlive's NPS/ National Pension System Calculator or NPS Pension Calculator is a FREE online tool that lets you calculate how much wealth and the expected pension you can expect from your NPS account at the time of your retirement. The calculator helps you to determine your monthly contribution and how much you need to increase to create the optimum wealth that can be sufficient for your retirement life.

Who can use the NPS Pension Calculator

The NPS calculator can be useful for those who have an NPS account and will also be useful for those who are going to open an NPS account in the future. Anyone whose intention is to get an idea about the corpus and the pension amount during retirement can use this calculator.

Benefits of Using the NPS Pension Calculator

- The NPS Pension Calculator is free. You do not have to pay a penny to use it. You can use it as much as you require.

- The easy-to-use tool will help you to estimate your NPS returns with just with few inputs and clicks.

- It's FAST! Pension calculation manually by pen and paper can be a very complex thing and a little bit time-consuming. The NPS Calculator is a very fast tool that takes just a few seconds to produce the result.

- You will have an idea about your future investment under your NPS account and the approximate pension you will receive during your retirement age.

- You can measure inflation impact while calculating Finlive's NPS Calculator.

How to use the NPS Calculator

NPS Calculator is an easy-to-use tool that helps estimate the returns of a National Pension System account. Here are the usage steps of the NPS Calculator:

- Visit finlive's and navigate to the NPS Calculator page.

- Provide the following inputs:

- Monthly Contribution: The amount you want to invest monthly basis.

- Duration: The number of years you wish to continue your NPS Account. The appropriate duration should be 60 minus your current age.

- Expected Rate of Return %: Your expected rate of return

- Purchase Annuity %: The percentage of annuity you wish to purchase during retirement. The annuity must be at least 40% as per the PFRDA guideline applicable to an NPS account.

- Expected Rate of Annuity %: The rate of annuity

- Click on the Calculate Now button to get the result of the calculation. The result contains the amount of profit, corpus, withdrawable lumpsum, and pension with a growth table and chart.

.jpg)

How to measure inflation in NPS Pension Calculation

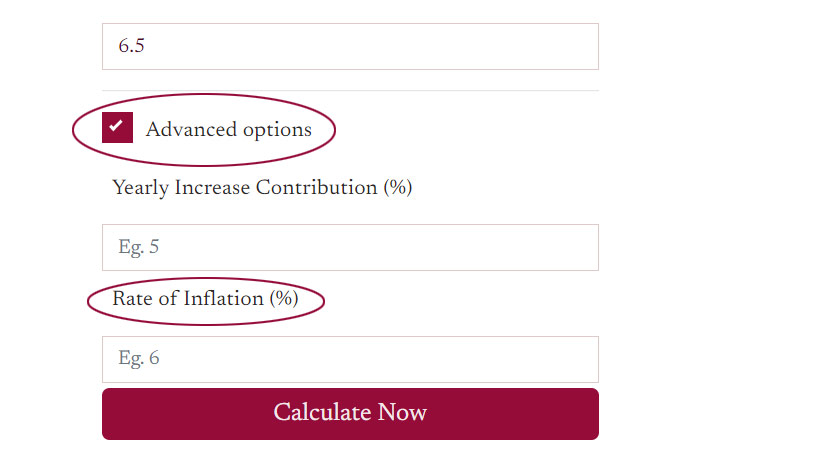

NPS Calculator enables you to measure the inflation effect on your retirement corpus and monthly pension. Here are the steps to use NPS Calculator with inflation:

- Provide mandatory inputs like Monthly Contribution, Duration, Expected Rate of Return, etc.

- Check on Advanced Options

- Provide Rate of Inflation (%) percentage

- Click on Calculate Now button

Step up NPS calculator - How to Use

NPS Calculator can also accept the percentage of incremental growth of your contributions over the year. This feature is helpful when you plan investments for a long horizon. Not only for a fixed monthly contribution but also you can get an estimation if you increase the contribution a certain percentage every year. In order to use this feature, you need to enter an amount as "Yearly Increase Contribution (%)" from the Advanced Options group.