SIP Calculator - Measure Mutual Fund Returns

SIP is a kind of financial plan for making periodic investments into a financial instrument. More specifically SIP or Systematic Investment Plan is an investment instrument for mutual funds. This instrument allows investors to invest with a fixed amount of installment on a monthly and quarterly basis.

There are certain advantages of making SIPs instead of one-time investment. Such as SIP offers the auto-debit facility, easy to manage like start, stop, and pause. Another advantage is SIP reduces the risks of market volatility. SIP Calculator is an online tool that will let you estimate your investment growth for a period over a SIP.

SIP Calculator - How to use

SIP Calculator is a financial calculator that calculates the future value of an investment over SIPs. You can calculate the expected return by providing some inputs like SIP amount, duration of investment, expected rate of return, etc.

Once you input the values then click on the calculate button to get the result. The result of the calculation includes expected profit, return, growth chart, etc will be shown.

Step-Up SIP Calculator - Measure growth over Incremental SIPs

Step-Up SIP Calculator is capable of calculating step-up investments. Want to increase your SIP investment amount annually? No Problem! Just input the percentage you wish to increase yearly basis.

Let's take an example. You want to increase 5% of SIP value every year. If your current SIP is Rs. 5,000, your yearly SIP amount will increase by 5%. So, the next year your SIP will become Rs. 5,250 and these will continue each year.

Measure Inflation Impact

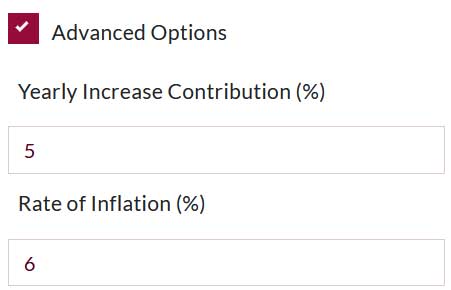

You can also measure the inflation impact on your investment. Getting the investment impact of inflation is easy. You need to check the 'Advanced Options' before the calculation and input the current rate of inflation. Once you submit, the calculator will show you the inflation-adjusted returns.

Advantages of SIP

SIP is a method investment in Mutual Funds and those funds invest in various financial sectors like quality, debt, bonds, etc. Due to this diversification, the risk factor of making investments into a mutual fund decreases. SIPs offers some more advantages:

SIP offers Invest into Mutual Funds

Mutual can be a good option for investing in stock markets indirectly. Purchase or sell direct stocks can be complex and a lengthy process. Also, investors need to have enough knowledge about stocks. With an equity mutual fund, an investor can invest indirectly in the stock market, without having such knowledge of stocks. Not only mutual funds invest in stock markets but also in corporate bonds, government securities, debt, or even some mixtures, which is called a hybrid mutual fund. Each type of mutual fund comes with different characteristics.

Easy to Invest and Manage

Nowadays, investment through SIP is extremely easy. You just need to have the internet and a smartphone. Almost all mutual fund houses offer their mutual fund app. With mutual fund apps, you can easily start and stop a SIP at any time. If you do this through a mobile app, you may need to have an internet banking facility of your bank. Internet banking will let you add mutual fund payee for auto-debits of your future SIPs. SIPs can be started also in offline mode. You just need to visit the mutual fund house and request for this.

Discipline in Investments

SIPs improve discipline in investments as a SIP small in nature and it comes with auto-debit feature. You need to ensure that your savings account is enough funds to process the SIP. In case of failure of SIP, banks charge an amount as penalty. This makes an investor very careful about the SIPs. SIPs are also comparatively very smaller than the lump-sum deposits. As a result, this makes no burden on investors.

Rupee cost averaging

In general, SIPs majorly invests in the stock market, and these investments are done through-out market sessions. At the end of the day, all cost of purchase units is average out. Due to this investment nature, market volatility does not impact much. On the other hand, your monthly SIP also reduces the risk factor as each month of SIPs are purchased at different prices. So, in the long term, the market risk gets very lower.

Frequently Asked Questions

Do I need a Demat Account to invest in Mutual Fund through SIPs?

No, Demat Account is not required for investing in Mutual Fund.

How much I need to pay as a SIP?

You can start with as low as Rs. 500 and there is no upper limit.

Can I stop my existing anytime?

Yes, you can stop anytime by yourself. Most Mutual fund applications provide this option in their 'Transact' section. It also can be done offline by visiting the fund house.

Can I temporarily pause SIP without stopping it?

Yes, the majority of Mutual Fund offers this facility.

Can I have more than one SIP of the same fund?

Yes, more than one SIP will not be an issue.