How to Buy Sovereign Gold Bonds Online

Do you want to invest in Gold? Or probably thinking of buying Sovereign Gold Bonds online. Buying Gold bonds online is a great idea. The Government of India is also encouraging buyers for online subscriptions of SGB and giving some extra benefits. Well, Let's discuss the Sovereign Gold Bond and how you can purchase it.

What is Sovereign Gold Bond (SGB)?

A Sovereign Gold Bond is a digital form of one-gram pure gold. Let's say if you want to buy gold bonds worth 10 grams, then you need to buy ten (10) units of Gold Bond. The gold bond is issued by the Reserve Bank of India (RBI) on behalf of the Government of India. RBI opens Sovereign Gold Bond for subscriptions in series per financial year. Each series opens for certain days with a fixed price and interest rate.

Also, read Gilt Funds - Features, Risk and Returns | Top Performing Gilt Funds

Sovereign Gold Bond (SGB) 2020-2021 Series

| Serial no. | Tranche | Date of subscription | Date of issuance |

| 1 | 2020-21 Series I | April 20-24, 2020 | April 28, 2020 |

| 2 | 2020-21 Series II | May 11-15, 2020 | May 19, 2020 |

| 3 | 2020-21 Series III | June 8-12, 2020 | June 16, 2020 |

| 4 | 2020-21 Series IV | July 6-10, 2020 | July 14, 2020 |

| 5 | 2020-21 Series V | August 3-7, 2020 | August 11, 2020 |

| 6 | 2020-21 Series VI | August 31-September 4, 2020 | September 8, 2020 |

| 7 | 2020-21 Series VII | October 12-16, 2020 | October 20, 2020 |

| 8 | 2020-21 Series VIII | November 09-13, 2020 | November 18, 2020 |

| 9 | 2020-21 Series IX | December 28, 2020- January 01, 2021 | January 05, 2021 |

| 10 | 2020-21 Series X | January 11-15, 2021 | January 19, 2021 |

| 11 | 2020-21 Series XI | February 01-05, 2021 | February 09, 2021 |

| 12 | 2020-21 Series XII | March 01-05, 2021 | March 09, 2021 |

Sovereign Gold Bond (SGB) 2021-2022 Series

| Serial no. | Tranche | Date of subscription | Date of issuance |

| 1 | SGB series 1 | April 17-21, 2021 | May 25, 2021 |

| 2 | SGB series 2 | May 24-28, 2021 | June 01, 2021 |

| 3 | SGB series 3 | May 31- June 04, 2021 | June 8, 2021 |

| 4 | SGB series 4 | July 12-16, 2021 | July 20, 2021 |

| 5 | SGB series 5 | August 09-13, 2021 | August 17, 2021 |

| 6 | SGB series 6 | August 30 - September 03, 2021 | September 07, 2021 |

| 7 | SGB series 7 | October 25 - October 29, 2022 | November 02, 2021 |

| 8 | SGB series 8 | November 29 - December 03, 2021 | December 07, 2021 |

| 9 | SGB series 9 | January 10 - January 14, 2022 | January 18, 2022 |

| 10 | SGB series 10 | February 28 - March 04, 2022 | March 08, 2022 |

Where to get Sovereign Gold Bonds available for purchase?

A resident of India can purchase SGB from various financial institutions like Banks, Post Offices, StockHolding Corporation of India Limited, or even from Stock Exchanges.

How to Buy Sovereign Gold Bond?

The ways of buying the Sovereign Gold Bonds are simple. You can buy SGB either offline or online. RBI issues SGBs for purchases in one or more tranches in a financial year. During the tranches, you can buy the Gold Bond as well.

How to Buy Sovereign Gold Bond Offline?

To purchase Sovereign Gold Bonds offline, you can visit any of your nearest authorized Banks, Post Offices, or Stock-broking Agency Offices during the tranches. All you need to submit an SGB application form along with supportive documents like AADHAAR, PAN number, etc. to the respective authority. Probably, they will give you a purchase receipt.

One thing you should note is that you will not have the Gold Bond on the same day of purchase. Your SGB certificate will be given only after the issue date. Once your purchased bonds are issued, you will be notified by email and SMS. Only after the issuance, you can collect the physical Sovereign Gold Bond Certificate.

Where to Buy Sovereign Gold Bond Online?

- Banks Net-Banking Portal: Almost all RBI recognized banks offers to buy Sovereign Gold Bond online. All you need to have a Bank account with an internet banking facility. Below I am going to share with you how to purchase Sovereign Gold Bond from SBI Netbanking.

- Stock Brokers: If you have a Demat account, you can buy SGB directly from stock-brokers. Some brokers, including Zerodha, offer to buy Sovereign Gold Bond from their portal. One advantage of buying SGB from brokers is, you can sell bonds anytime in the secondary market.

- Stock Exchanges (BSE/ NSE) (Secondary Market): If you do not want to wait for tranches, you can purchase SGB anytime from stock exchanges. This option allows you to buy already issued Sovereign Gold Bonds from different bond-holders.

Key Benefits of Buying Sovereign Gold Bond Online?

Paperless

Buying Sovereign Gold Bond online is completely paperless. Submission of any hard copies is not required at all. If you buy SGB in online mode, you will receive an e-Certificate in your registered mail. Due to the softcopy, you need not worry about losing it.

Exclusive Discount

The main advantage of buying SGB online is to get a discount of Rs.50 for each unit of the bond. The Gov. of India offering this exclusive discount for promoting online purchases.

Let's take an example: Assume the price of one unit of SGB is Rs. 4500 and you want to buy 20 units of it. Now, if you buy it offline, you have to pay 20 x Rs. 4500 i.e. Rs. 90,000. But if you choose an online buying option you will get a discount of Rs.1000 (50x20) and you have to pay 20 x Rs. 4450 i.e. Rs. 89,000. This is the main reason most buyers prefer buying SGB online.

Tax Benefits and GST

The capital gain raised in the case of SGB redemption is waived. The GST on the purchase of Sovereign Gold Bond is also exempted.

Also Read: How to Save Money - 10 Simple Money Saving Tips

How to Buy Sovereign Gold Bond from SBI Netbanking?

If you have SBI net-banking facility, you can easily buy Sovereign Gold Bond from the SBI Netbanking portal. During the tranches, the State Bank of India (SBI) opens the buying window for that period. With two simple steps you can buy SGB from SBI Netbanking:

One-Time Registration

To purchase SGB, you first need to register yourself. Here is the registration process:

- Visit SBI Net-banking Portal.

- Login into your account

.jpg)

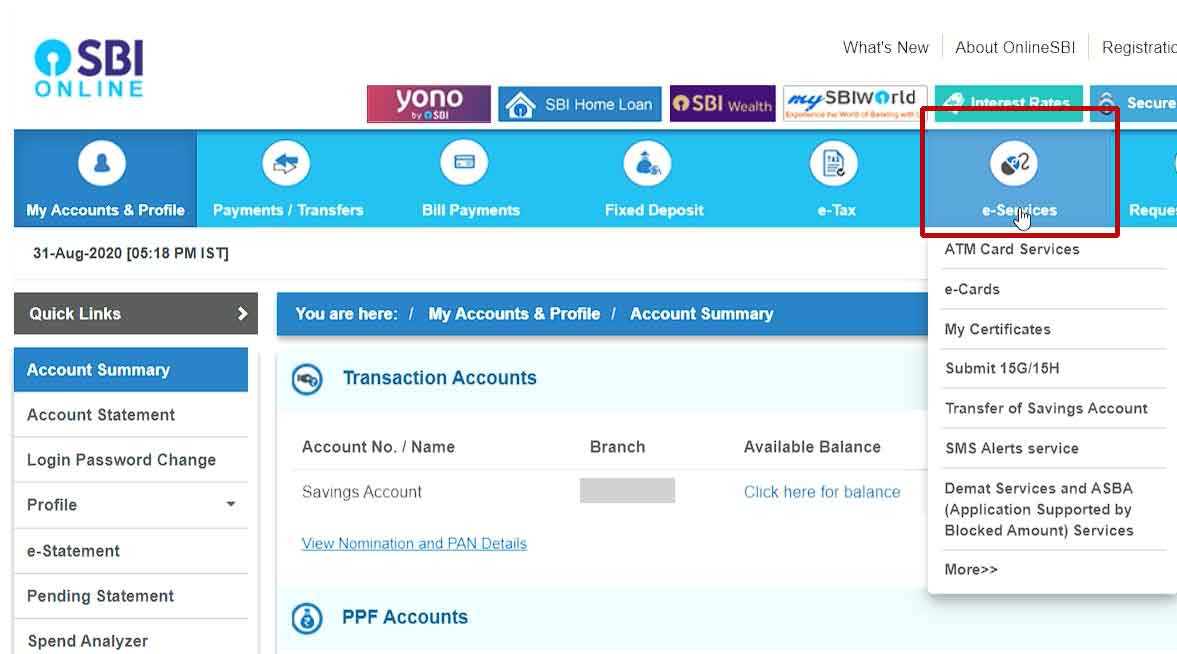

- Click on the “e-Services” option from the main menu.

- Now, you have to choose the “Sovereign Gold Bond Scheme” from among the listed options.

.jpg)

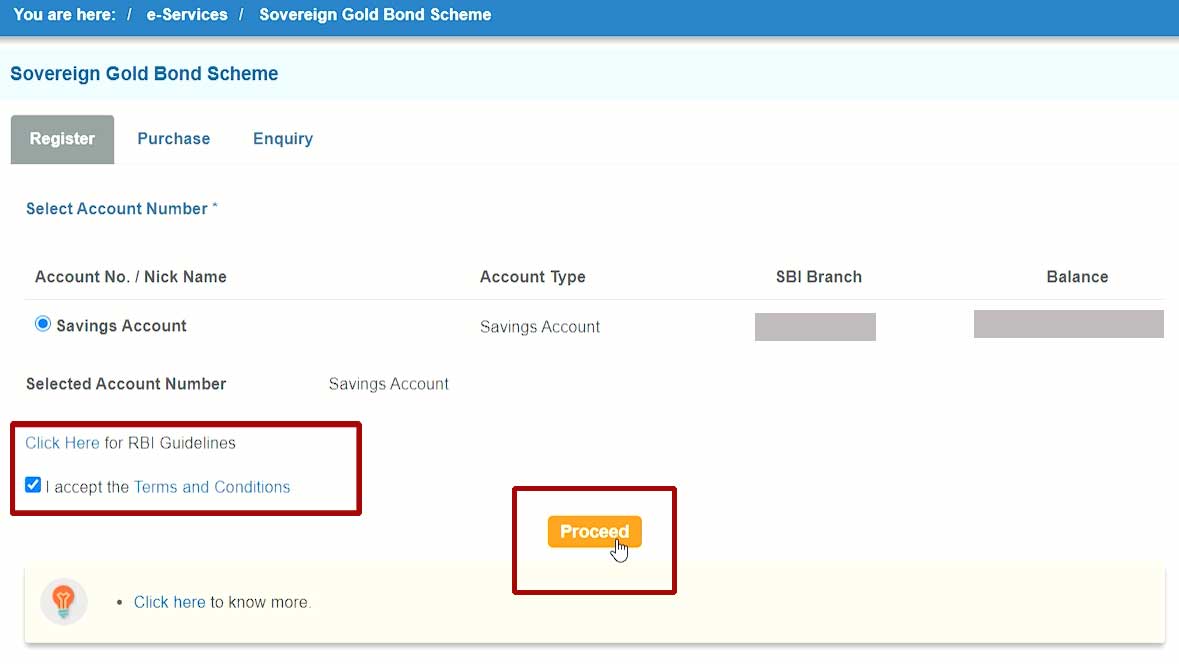

- Click on the “Register” tab under the “Sovereign Gold Bond Scheme” section.

- Once landed on the “Sovereign Gold Bond Scheme” page, you will see your list of accounts is listed there.

- Check on the Debit Account or your Savings Account

- Check the “I accept the Terms and Conditions” checkbox and click on the “Proceed” button to fill the registration form.

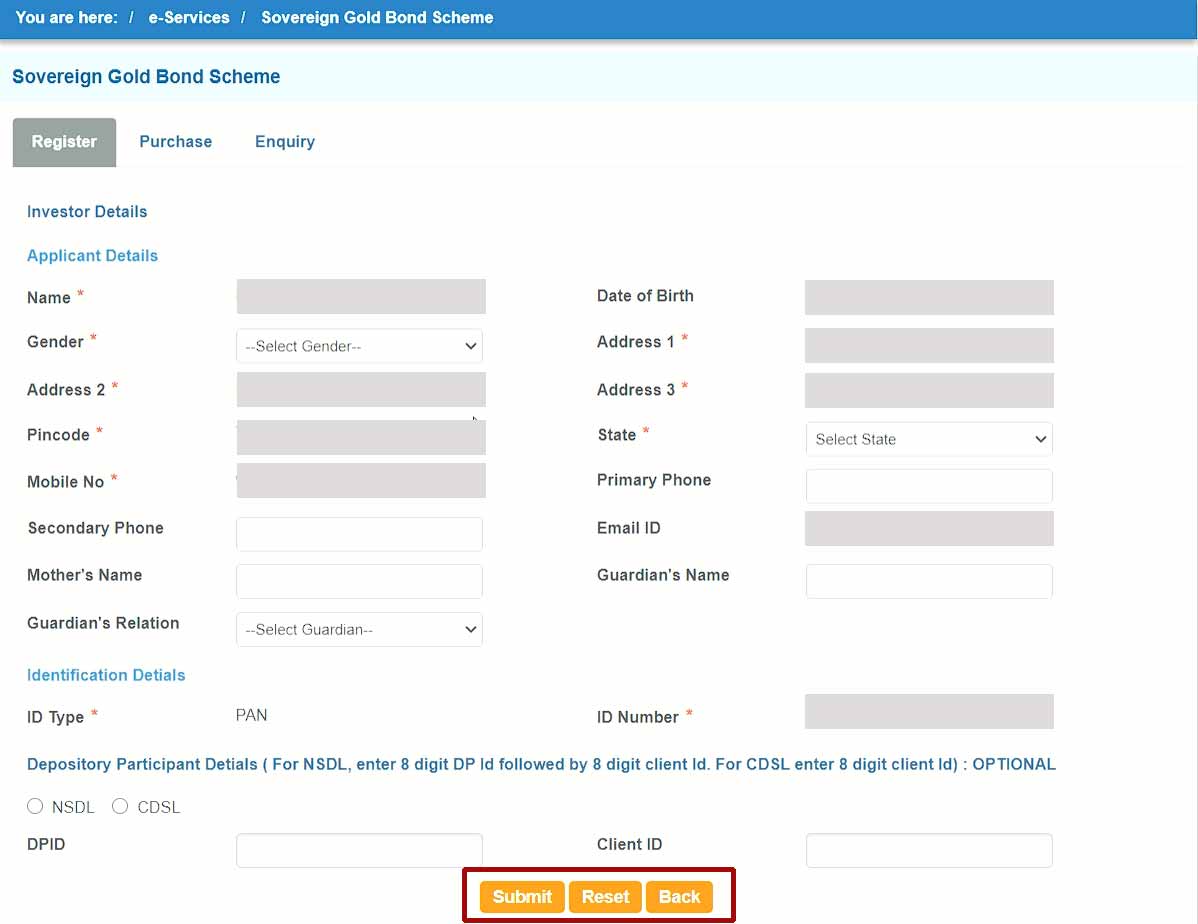

- Now, you need to fill the one-time SGB registration form with some mandatory or optional inputs. You will see some inputs are already filled. All you need to fill in the remaining inputs and click on the "Submit" button.

Note: If you do not have any Demat account, avoid the “Depository Participant Details” option. However, if you have one, you may or may not provide those account details. It is not mandatory. One advantage of providing a Demat account during registration details is, you can sell your purchased bonds in the secondary market anytime before maturity.

- Upon successful registration, a unique SGB Registration Number will be provided. You should note that number for future references.

Purchase

On successful registration, you can purchase SGB from SBI Net-Banking during the tranche. Here are the steps of buying a Sovereign Gold Bond from SBI Internet-Banking:

- Visit SBI Net-banking Portal

- Login into your account

- Click on the “e-Services” option from the main menu.

- Now, you have to choose the “Sovereign Gold Bond Scheme” from among the listed options.

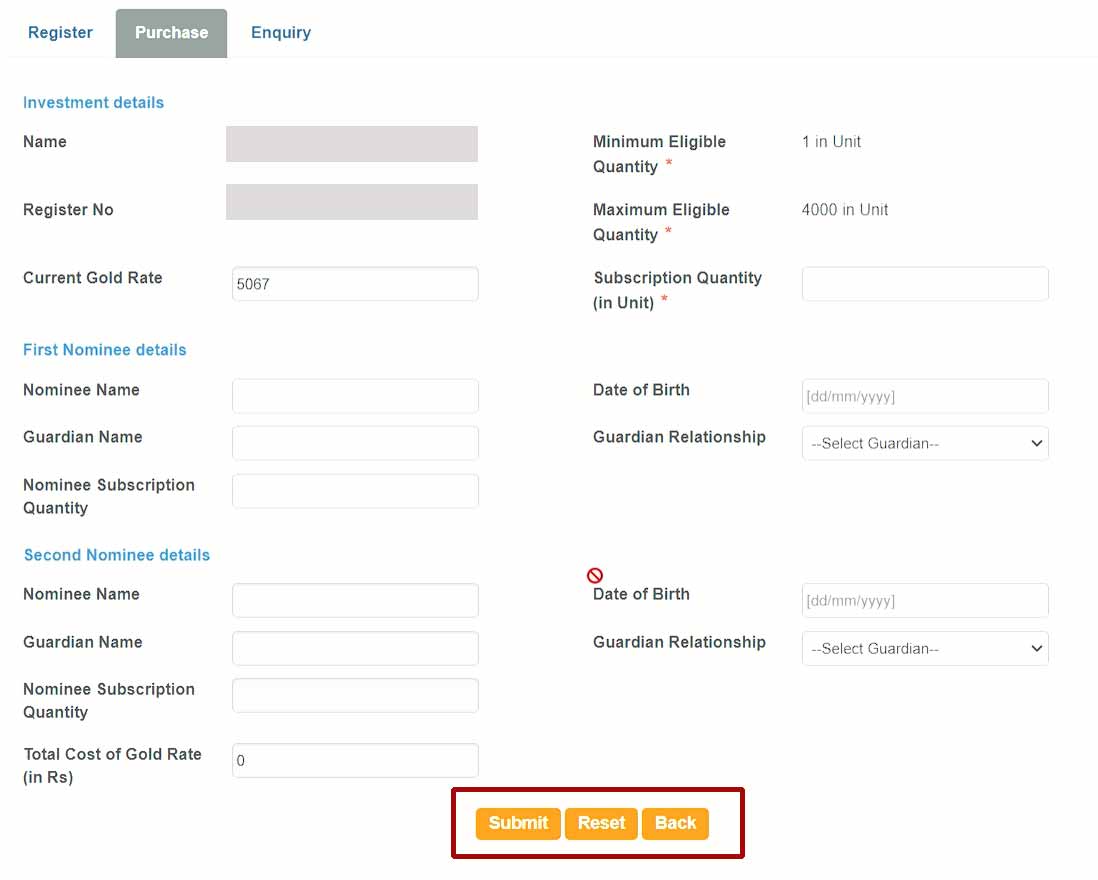

- Click on the “Purchase” tab under the “Sovereign Gold Bond Scheme” section.

- Once landed on the “Sovereign Gold Bond Scheme” page, you will see your list of accounts is listed there.

- Check on the Debit Account or your Savings Account

- Check the “I accept the Terms and Conditions” checkbox and click on the “Proceed” button to buy the gold bond.

- On the purchase form you have to fill in some inputs like the following:

- Subscription Quantity

- Nominee Details

- Once you fill the purchase form, click on the ‘Submit’ button.

- If everything goes fine, the price of SGB will be deducted from your Debit Account. You will receive a confirmation message/ mail very soon after the purchase. Eventually, on the SGB issue date, you will receive the e-Bond certificate in your registered email account.

How to Buy Sovereign Gold Bond from Online Broker Zerodha?

The easiest way to buy SGB is to get it from Stock Broker Services. The Stock Brocker Zerodha offers to buy SGB online. In the presence of a Zerodha trading account, an individual can place purchase orders of Sovereign Gold Bonds during the tranches. Here are the steps:

- Visit Zerodha Gold Portal

- Click on the "Invest Now" Button

- Log in using your Zerodha Kite credentials.

- Select the "Sovereign Gold Bond" option from the gold investment list.

- Input the number of bonds you want to purchase in the Quantity input box and click on the "Place Order" button.

- The purchase price will automatically be deducted from the Zerodha Wallet on the date of the issue or the last date of the trench. On the next working day, purchased gold bonds will reflect in your Demat account.

How to Buy Sovereign Gold Bond (SGB) from the Secondary Market using Zerodha Kite?

If you wish to buy Sovereign Gold Bond, you can buy it from the secondary market as well. The Secondary Market allows you to buy or sell SGBs anytime during market hours. Here I am going to tell you how can you purchase SGB using Zerodha Kite. First of all, you must have a Demat account along with a Zerodha trading account. Here are the steps:

- Open the Zerodha Kite mobile application.

- Search for 'SGB'

- You will find a lot of SGB options available to buy.

- Select any SGB option from the list according to your choice

- Your chosen SGB will be added to the watchlist

- Anytime you can place the purchase order during the market session.