How To Hedge Against Inflation With Your Investments

Earning money and saving both are challenges. You must be aware that the value of money keeps on decreasing. This means that goods you can buy in a thousand rupees today will be more than what you can buy next year. Do you know the reason behind this? Well, this is the result of inflation.

The consequences of the easy money given by central banks to battle the COVID-19 worldwide appear in the form of inflation. Inflation lessens the ability to buy goods and services. All in all, it reduces purchasing power.

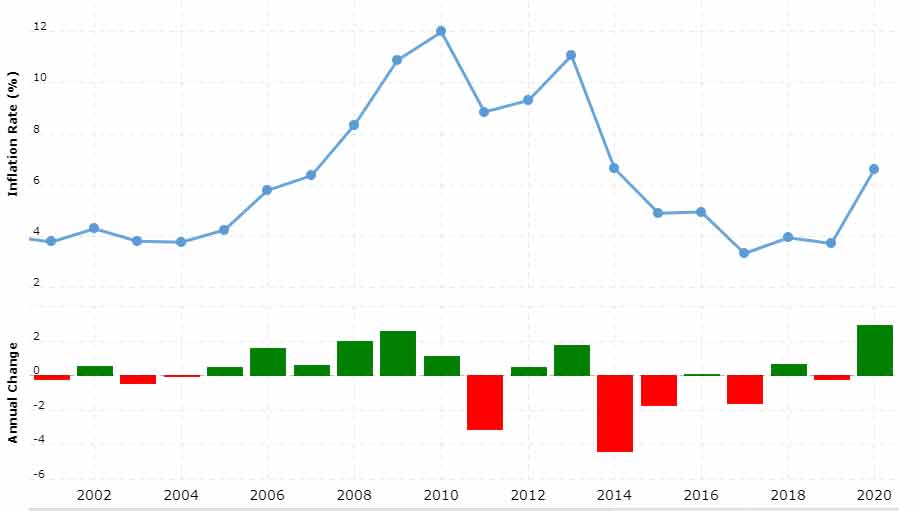

The rise in inflation increases the cost of living. The retail inflation in India was 4.23% in April 2021. It raised to 6.3% in May 2021. It fell to 5.78% in August.

Read on further to find out what inflation is and the investment options to beat inflation in India.

Retail Inflation Chart in India (image source - macrotrends)

Why Is Inflation Supposed To Be Increasing In India?

Rising inflation is predicted to be a severe problem for India’s economy as the nation has recently battled a third wave of pandemics. Soaring prices have been a problem for India for more than two years now. The central banks have anticipated that the new variants of covid-19 infection could sustain inflation.

Investors assume that inflation will be a hurdle for 2022 markets. They are troubled about how investments may get affected.

Every problem had a solution, right? There are ways to ensure that your hard-earned money doesn't suffer the brunt of inflation.

Every investment is not impacted adversely by inflation. You only need to discover the exact techniques to reduce the impact of inflation on your possession.

India's Rising Inflation (2017-18) (image source - MOSPI and Trading Economics)

Beating Inflation: What Does It Mean?

With every passing year, the buying power of money reduces considerably for several reasons. As a consequence, rates of goods and services increase. This economic phenomenon is termed inflation.

Beating inflation signifies receiving higher returns on investment in comparison to the inflation rate of the economy. If the rise in rates of goods and services surpasses the returns you profit from on investments, your returns are invalid.

In simple words, think that you invested a thousand rupees in an investment. You got a return of 4% in the best year. Your investment now is 1000+40. But the rate of the economy's inflation is 5%. This is more than the 4% return on your investment. The high inflation rate will cancel out your gain or return your received.

What Are The Ways To Beat Inflation In India?

Investing with a proper roadmap that yields higher returns is the best way to beat inflation in India. The investments that have a great chance of being more significant than the rate of inflation in the future will beat inflation. Investors should be vigilant enough to perform detailed research on their goals and risk profile when choosing the best investment instrument for beating inflation.

It might not be easy to evaluate your financial goals and risk profile. Receiving financial advice from a registered investment advisor can best assist you to get financial advice in setting your financial goals. The most significant step to remember during investments is diversification.

A few investments can give extremely high returns. This can be incredibly true in the case of equity-oriented investments. However, they also come with some risks. It is crucial to diversify your investments following your goals, risk, and inflation expectations.

Let’s have a look at some great investment options to outperform inflation. We will access their past performance. Do remember that past performance doesn't guarantee any promising future performance.

Equity Investments:

Equity offers protection against inflation. This happens because an increase in price leads to rising in nominal revenues. This ultimately increases the share prices. Its impact differs from sector to sector, but it retains the ability to give higher input costs to its consumers.

Selecting the right company for investment is essential to beat inflation. For example, it is ideal to invest in energy stocks as these companies raise their prices with inflation. This helps them to retain their profit. This will bring profit to the investors as well.

Investing in Quality Stocks

Stocks markets for a very long time, have beaten inflation. Inflation raises the production cost of companies. The production includes labour costs and materials costs. This consists of both buying and borrowing. It limits their future earnings and lowers expected earnings.

Although higher inflation leads to a hike in rates that affects stock market returns adversely, a few sectors act as a hedge as they are likely to appreciate during this time. Two sectors that investors often go to are utilities and materials. The stocks surge with the rise in the price of raw materials. The utility sticks function as a bond hybrid and generate income with dividends.

Commodities:

"Commodities tend to have outsized returns during times of high inflation," ~Adem Selita, CEO of the Debt Relief Company.

Commodities can include real assets like raw materials, crops, and natural resources. These also include gold, silver, and energy commodities like gas and oil.

Precious Metals

Glitters are gold, particularly during inflation. Gold is a hedge against inflation because of its rarity.

Historical evidence favors the link between precious metals and inflation. Valuable metals like gold and silver are limited. They benefit from negative real interest rates and inflation. You can't print these precious metals like paper currencies. Their supply is limited. They retain their value even when the currency reduces its value.

Gold and silver are valuable due to their scarcity and highly conductive aspect. It is instrumental in electronic applications and other emerging industries. During inflation, the investors choose solid and stable investment options like gold and silver. As a consequence, their demand increases. This gives them added advantage against inflation.

Gold & Gold ETF

Apart from investing in physical gold, you can invest in ETFs and currency-hedged good funds. Some of these include SBI Gold ETF, HDFC Gold ETF, UTI Gold ETF, Axis Gold ETF, ICICI Prudential Gold ETF, and IDBI Gold ETF.

Historical Gold Price Chart in India

Government of Bank issued Gold Bonds

Sovereign gold bond schemes are gold bonds issued by the government. They are the perfect substitutes for investing in physical gold. The RBI issues the Bond on behalf of the Indian Government.

Real Estate:

As per the survey conducted by real estate agencies in India, you can enjoy a 10% profit by investing in real estate.

The real estate return might be the best investment option, but the vast money required is. You need a high capital to invest in real estate. It can cost you lakhs and crores. You might need to take a loan from the bank to do this. The returns should be big enough to cover up the interest and give you a profit.

Debt:

Debt funds or bonds that require investing in bonds work closely related to interest and, ultimately, inflation rates. The interest rate rises with rising in inflation.

The bond price and interest rates are in opposite directions. Therefore, bond prices will drop in this case. But with diversification, you can manage returns and capital preservation.

Government Securities

The majority of bonds do not hedge against inflation. The explanation behind this is the fixed rate of interest for long lifespans. Their rates on the secondary market can change, but the interest rate is not adjusted.

However, few bands like the TIPS (US Treasury Inflation-Protected Securities) have interest rates that change with inflation. The interest rises with the inflation rate and decreases with deflation. This is possible because the US government supports them. This is an incredible choice for investors.

Inflation-Indexed bonds

The Indian government mainly designs Inflation-indexed bonds to beat inflation. The investors get good returns. The RBI looks at this on behalf of the Indian government. They employ an index ratio to determine the principle to beat inflation.

Alternative Investments

Real assets like vintage cars, fine art, and other such collectibles can help to hedge against inflation. However, they can be pretty risky. Also, these are tangible assets that have offered value to collectors. The price of these collectibles is hard to predict. Still, their value is expected to rise over time. This will ensure greater returns in comparison to the inflation rate.

Another investment options are cryptocurrencies. They are much in trend. Bitcoin and Ethereum are a few cryptocurrencies. They may prove to be a good investment against inflation as their supply is limited. But when talking about its earlier performance, it is not sure how it'll perform during inflation.

Bottom Line

Inflation comes with many consequences. It can deplete your savings. While maintaining some money for your expenses, you must look for financial security—plan for inflation ahead by choosing the suitable investment yourself.

Make your money earn so that you don't erode your cash in the coming years. Choose a strategy that I'll fetch you returns to beat the inflation rate or keep up with it. Invest in assets that appreciate. By panning for inflation, you can retain the value of your wealth and grow it simultaneously.

Inflation affects people on an individual level. As a wise investor, what are your plans to save your money from inflation? Let us know in the comment section which idea suits you the most according to the current inflation levels.