Nifty 50 Vs. Nifty Next 50 Index Fund | Which is Better?

In recent years, the large Cap segment has become very demanding among mutual Fund Investors. If you are quite passionate about Large Cap Index Funds, you should consider two indices– NIFTY 50 and NIFTY Next 50. While they fall under the category of large-cap indices, they are different in their way of construction.

Passive investing is a booming industry now. This momentum has resulted in AMCs bringing several passive funds to track various indices. And that is the reason you need to understand why should you invest in index mutual funds. A little deeper knowledge of the underlying criteria and their techniques becomes important for a more mindful selection of these funds.

Which will be better for your investment decisions- Nifty 50 or Nifty Next 50? In this blog, we will know the details of the two indices.

Nifty 50 depicts the biggest Indian companies according to the scale of operations and market leadership. Nifty Next 50 constitutes the next 50 of the biggest listed companies in the Nifty 100 index. Let's look at the parameters to choose the best investment option between the Nifty 50 and Nifty Next 50 index.

Understanding Nifty 50 & Nifty Next 50 index

We all have heard NIFTY in the stock market index, right? So, what is NIFTY 50 and NIFTY Next 50?

NIFTY 50

Nifty 50 represents 50 companies that are chosen from the universe of NIFTY 100. It is based on liquid companies and free-float market capitalization. These companies retain an average impact cost less or equal to 0.50% for 90% of the observations (considering a size of Rs 10 crore). The constituents must have derivative contracts accessible on National Stock Exchanges (NSE).

NIFTY Next 50

Earlier known as the NIFTY Junior index, Nifty Next 50 is the index of the 50 companies from NIFTY 100(omitting the Nifty 50 companies). It aims at assessing the performance of large market capitalization companies.

The NIFTY 100 checks the behavior of both NIFTY 50 and NIFTY Next 50

Sectoral Representation and Weightage of Nifty 50 and Nifty Next 50

| WEIGHT(%) | ||

| SECTOR | NIFTY 50 | NIFTY NEXT 50 |

| Financial Services | 38.23 | 20.10 |

| IT | 16.72 | 2.48 |

| Consumer Goods | 10.54 | 16.98 |

| Oil and Gas | 12.35 | 5.18 |

| Automobile | 5.06 | 1.18 |

| Metals | 3.53 | 10.51 |

| Pharma | 3.31 | 8.00 |

| Cement and Cement Products | 2.51 | 4.04 |

| Construction | 2.78 | 2.01 |

| Power | 1.65 | 5.76 |

| Telecom | 2.11 | 1.79 |

| Consumer Services | 0 | 10.31 |

| Services | 0.66 | 1.71 |

| Fertilizers and Pesticides | 0.53 | 1.97 |

| Healthcare Services | 0 | 3.50 |

*The data is of October 2021

.jpg)

Conclusions that can be drawn with the table above:

- The sectors have different weights in different indices

- Nifty 50 is more inclined towards IT, Financial Services, Consumer Goods, and Oil & Gas.

- Night Next 50 is inclined towards Consumer Services, Consumer Goods, Pharmaceuticals, Metals, and Financial Services

- The contribution of the best 5 sectors in Nifty 50 and Nifty next 50 are 82.9% and 65.9%. This implies that NIFTY Next is more diverse than NIFTY 50.

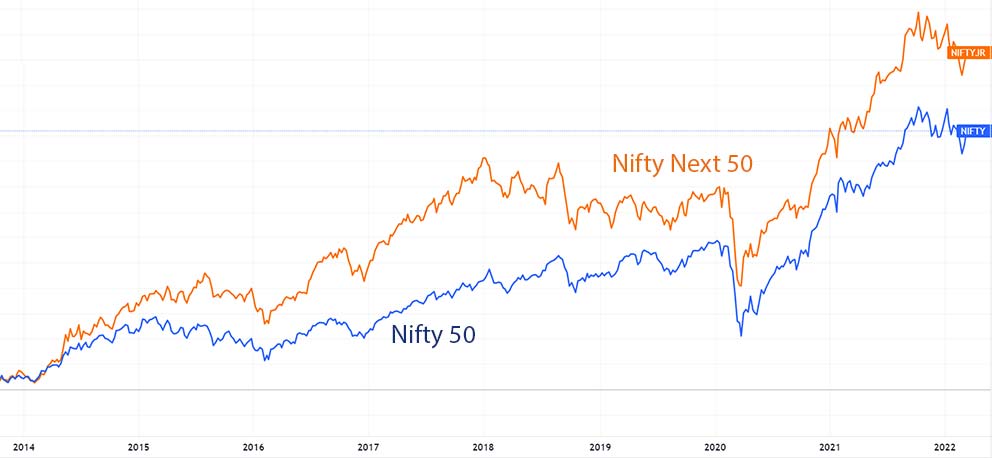

Which gives better Long-term performance

- Over the past years, the Nifty Next 50 index has provided a return of 16 % (CAGR). The Nifty 50 Index has provided a return of 13.5 % (CAGR). The Nifty 50 next has outperformed around 255 bps during a 10-year duration.

- Nifty Next 50 began to exhibit distinguished performance in 2015. The outperformance has increased in recent years because the developing sectors have attained more significance than the old ones.

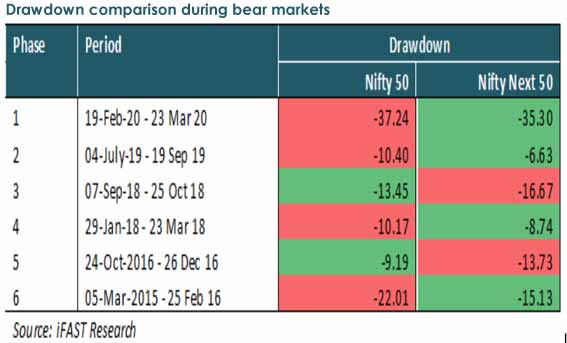

- Apart from exceeding the Nifty 50 in the long period, the Nifty Next 50 has undergone lesser drawdowns when seen in the bear market cycles. Nifty Next 50 index has small drawdowns as compared to Nifty 50.

Returns - Nifty 50 vs Nifty Next 50

Very similar to equity investment, Nifty 50's and Nifty Next 50's performance has been unstable. However, the index has hit inflation by a significant margin.

When looking into the last 15 year's data, the average annual return provided by NIFTY 50 is almost 12%. For instance, if you've invested Rs 10,000 every month since January 2007, the NIFTY 50 investment will be at Rs 55.05 lakh by August 2022.

Mutual Fund Returns Calculator

The NIFTY Next 50 index has also noticed several ups and downs. However, in the last 15 years, it has provided almost 14.2% average annual return. For instance, If you've invested Rs 10,000 every month since January 2007, the NIFTY NEXT 50 investment will be Rs 69.32 lakh by August 2022.

Do NIFTY next 50 index funds make sense?

Considering that NIFTY 50, and NIFTY Next 50 are large-cap indices, you may believe the identical performance from them. Nonetheless, this is not true. The risk-reward spectrum is completely different. NIFTY 50 involves less risk, the Next 50 index carries relatively higher volatility risk. Although, Nifty Next 50 produced higher returns in past years.

Analysis of data demonstrates that in the last 19 years, 51 out of the 75 stocks have been from the Nifty Next 50 that have graduated to the Nifty 50 Index.

In the last few years, at least 5 AMCs have begun schemes on the Nifty Next 50 index. It helps in tracking the performance of 50 companies in the Nifty 100 Index after removing the constituents of the Nifty 50 Index.

The broad assumption for the Nifty Next 50 is that they are the evolving large-cap companies that will come to be part of the mainline indices. These companies will be functional at a much bigger valuation.

In terms of structure, the main five constituents of the Nifty Next 50 index are Apollo Hospitals Enterprise Ltd, Avenue Supermarts Ltd, Adani Enterprises Ltd, Info Edge (India) Ltd, and Vedanta Ltd.

The financial services have the biggest weightage in the Nifty 50. This means that the performance of Nifty 50 is largely relying on one sector. The experts have acknowledged that the Nifty Next 50 might outperform the traditional Nifty 50.

Weightage of the best stocks in Nifty 50

- Reliance Industries: 9.83%

- HDFC Bank: 9.29%

- Infosys: 8.52%

- Housing Development Finance Corporation: 6.79%

- ICICI Bank: 6.7%

- Tata Consultancy Services: 5.28%

- Kotak Mahindra Bank: 3.46

- Hindustan Unilever: 3.27%

- Axis Bank: 2.73%

- Larsen & Toubro: 2.72%

Weightage of the best stocks in Nifty Next 50

- Apollo Hospitals Enterprise: 4.21%

- Info Edge (India): 4.02%

- Avenue Supermarts: 3.79%

- Adani Enterprises: 3.67%

- Godrej Consumer Products: 3.5%

- Vedanta: 3.22%

- Dabur India: 3.05%

- Adani Green Energy: 3.01%

- ICICI Lombard General Insurance Company: 2.93%

- Pidilite Industries: 2.92%

Comparison Nifty 50 and NIFTY next 50

| Rolling Returns | |||

| Index Return(%) | 1 Year (Absolute) | 3 Years (Average) |

5 Years(Average) |

| Nifty 50 | 53.54 | 10.9 | 12.9 |

| Nifty Next 50 | 54.81 | 13.3 |

15.5 |

Conclusion

One of the important ideas of investment is minimizing the risk exposure by diversifying your portfolio. The well-performing index funds are UTI Nifty Index Fund, IDFC Nifty Fund, SBI Nifty Index Fund, Aditya Birla Sun Life Nifty 50 Index Fund, Axis Nifty 100 Index Fund, Franklin India Index NSE Nifty Fund, etc.

If you wish to invest in index funds, you can opt for both -Nifty Next 50 and Nifty 50. However, higher allocation on the nifty next 50 makes sense as this index is better diversified than the nifty 50. Last few years Nifty Next 50 is consistently beating Nifty 50 funds in terms of returns.

Investors should remember that investment in a Nifty 50 or Nifty Next 50 fund should be as per their asset allocation, investment requirements, and risk profile.