FIRE Calculator | Calculate Your Early Retirement

Retirement is the most important stage of an earning person. Typically, retirement is when one person stops his/ her active money-making journey. The age is not fixed, however, in India we generally consider 60 to be the ideal age for retirement. The age is whatever it is, but planning one's retirement is one of the most critical decisions for an earning personnel. But how do you plan a retirement? It is really a complex and time-consuming task. But there is good news. With FINLIVE's FIRE Calculator, you can plan your retirement within a few seconds. So, let's understand how to use the FIRE Calculator.

What is the FIRE Number?

The FIRE number is nothing but the corpus required for your retirement. Typically, the number or the corpus amount should be enough to spend your post-retirement lifespan without actively engaging in earning money during that phase.

How to use the FIRE Calculator?

Using the FIRE Calculator is easy just like that. All you need to provide the following inputs:

-

Present Monthly Expenses: The amount of money you spend each month. It helps determine how much you'll need in retirement to maintain your current lifestyle.

-

Current Age: Your current age, will be used to calculate how many years you have until retirement.

-

Expected Retirement Age: The age at which you plan to retire. This helps calculate the time remaining until you retire and how long your savings need to last.

-

Your Present Corpus: The total amount of money you have saved or invested for retirement so far. This is the starting point for your retirement planning.

-

Expected Growth Rate (CAGR %): The average annual growth rate of your overall investments. It reflects how much your savings are expected to grow over time.

-

Inflation Rate (%): The rate at which the cost of living is expected to rise. It helps estimate how future expenses will increase and adjusts the value of your savings accordingly.

Once you entered all inputs, you need to click on the 'Calculate Now' button. Within a second, your estimated retirement plan will be displayed. Let's discuss what information you can expect from this FIRE Calculator.

- Future Expenses: The calculator will project you the estimated future cost of your expenses during your retirement. That includes monthly and annual expenses.

- Future Value of Present Corpus: You can also measure the future value of your present corpus.

- Required Corpus at Retirement: The most important figure, yes the estimated corpus you will need during your retirement journey.

- Monthly Savings Required: This is a bonus for you. Not only required corpus, but this calculator gives you one critical piece of information to reach your early retirement goal, which is the estimated monthly savings amount.

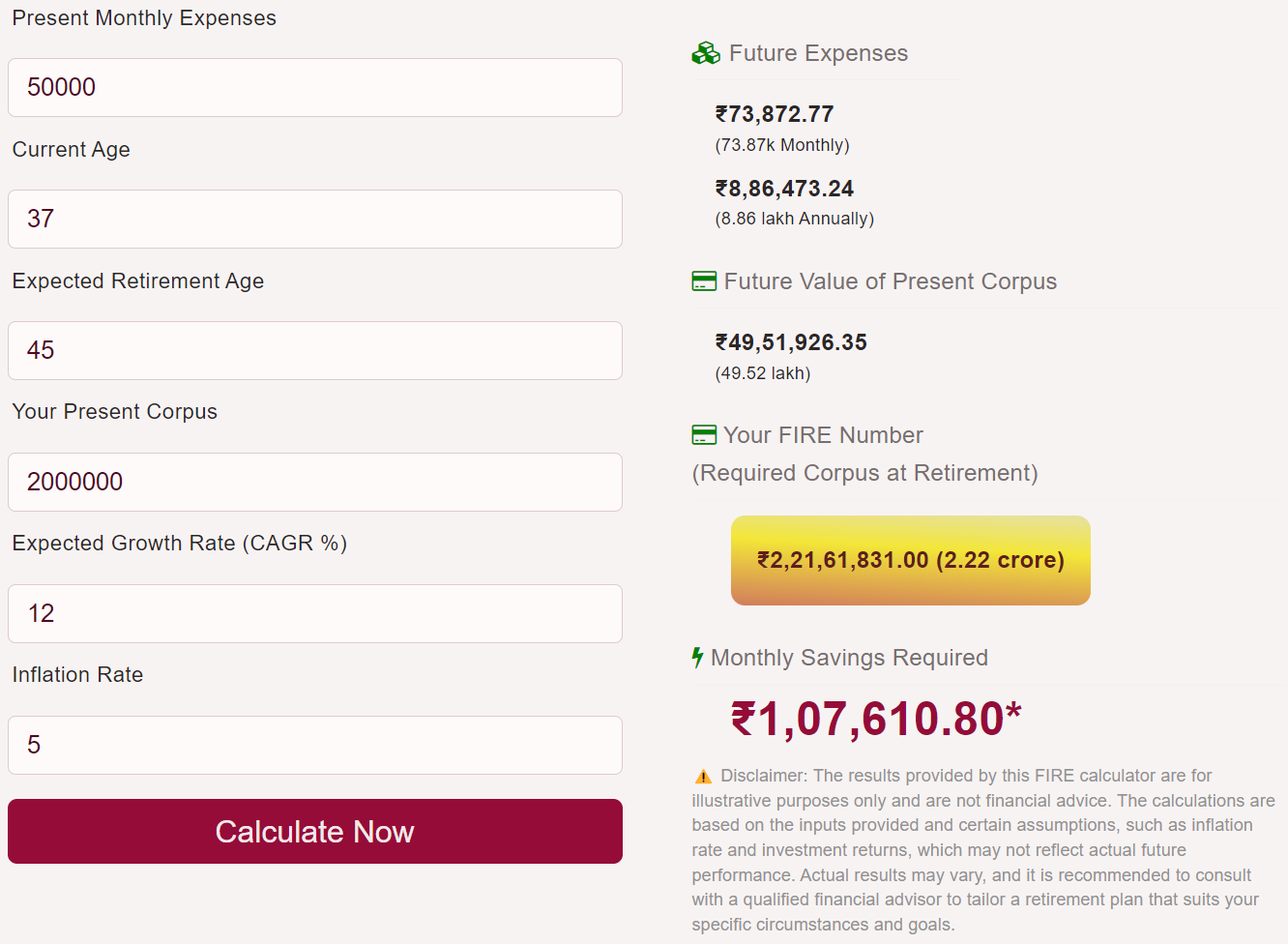

Let us understand with the following example:

- Current Age: 37 years

- Retirement Age: 45 years

- Current Monthly Expenses: ₹50,000

- Inflation Rate: 5% per annum

- Investment Returns (CAGR): 12% per annum

- Present Corpus: ₹20 lakh

Future Monthly Expenses at Age 45:

- Adjusted for 5% annual inflation over 8 years:

- Future Monthly Expenses: ₹73,872.77

Annual Expenses at Age 45:

- Annual Expenses: ₹8,86,473.24

Corpus Needed at Age 45:

- Required Corpus: ₹2,21,61,831.00

Projected Value of Current Corpus at Age 45:

-

Considering 12% CAGR for 8 years

-

Future Corpus: ₹49,51,926.35

In this example, to achieve the additional corpus of ₹1.73 crore by 45, approximately ₹1,07,610.80 per month of savings will be required.