Atal Pension Yojana (APY) - Eligibility, Pension and Other Benefits

The Government of India introduced Atal Pension Yojana (APY) in 2015 for securing the future of unorganized sector workers with a fixed pension amount. This scheme is managed by the Pension Fund Regulatory and Development Authority of India (PFRDA) under the National Pension System (NPS). Prior to the year 2015, there was a similar pension scheme called Swavalamban Yojana, but the scheme was unable to popularize it. The Atal Pension Yojana scheme allowed migration of existing Swavalamban Yojana Scheme to the APY scheme without creating a new one. However, the Government of India is not allowing the new Swavalamban Yojana subscription after introducing the APY scheme.

The APY account can be opened from post-offices as well as from authorized banks. A citizen of India can opt for this scheme between the ages of 18 to 40 years. After attaining the age of 60 years, the subscriber will be received the chosen fixed pension per month. Premature account closure and withdrawal both are allowed under the APY scheme with some pre-defined and exceptional conditions.

The auto-debit facility makes the way of contributions is trouble-free and trustworthy. In case of delay in making payments, subscribers will have to pay nominal penalty charges. In case of death of the subscriber, the accumulated corpus will be given to the spouse. And in case of the demise of both subscribers and spouse, the corpus will be given to the nominee.

Available Pensions under Atal Pension Scheme (APY)

Subscribers of APY can choose a monthly pension option from among Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000, and Rs. 5000.

Eligibility Criteria of APY

The Atal Pension Yojana is open for every citizen of India. The subscriber of the Swavalamban Yojana Scheme can also migrate into the APY scheme. The following criteria need to be fulfilled:

- APY is only applicable to them who do not have an EPF or EPS account.

- Age should be between 18 to 40 years

- Individual must have an Aadhaar ID and Aadhaar linked bank account

- Must have a valid and active mobile number

- Subscribers should continue contributions for a minimum of 20 years

How to apply

A savings account holder of Bank or Post Office can open an APY account. Presently, online and offline account opening are both available. However, the Post Office does not offer an online APY account opening facility.

Offline-mode: Through offline-mode individuals can submit account opening form along with the necessary hard copies of documents. The application forms are available in most regional languages, such as Hindi, English, Bengali, Marathi, Telugu, Gujrati, Tamil, etc. Along with the filled application form, the following documents will be required:

- An Identity Proof

- Aadhaar Card

- A valid Mobile Number

Online-mode: If you have an internet banking facility of an authorized bank, you can apply for an APY account online. In this case, you may not have to submit any physical documents. On successful account opening, you will receive an acknowledgment document mentioned you PRAN (Permanent Retirement Account Number) from the internet banking portal.

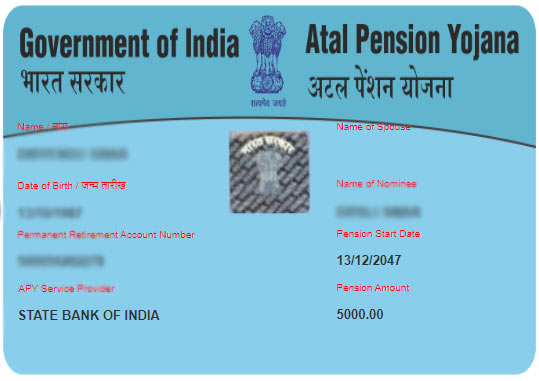

How to get the ePRAN card of APY?

Under NPS (National Pension System), a PRAN or Permanent Retirement Account Number is a unique number allotted to a subscriber after opening a pension account. This number will be required through the lifespan of the subscriber. In-short a PRAN uniquely identifies a subscriber.

After opening the APY account, the subscriber will receive a PRAN number on his/ her registered mobile. As of now, physical PRAN card is not available for APY subscribers. However, in order to get the ePRAN card, a subscriber can download it from the official website of NSDL. After a small account verification process, the subscriber will get the softcopy of the PRAN card.

Monthly Contribution

The pension scheme starts from Rs 1000 and increases multiples by Rs.1000 up to Rs. 5000. At the age of 18 to 40 years, every citizen of India is eligible for the APY scheme. Monthly contribution depends upon the pension amount and the age of the subscriber at the time of subscription. The subscriber needs to pay the calculated monthly contribution until his/ her 60th birthday. The minimum contribution duration is 20 years and the maximum is 42 years which will be applicable according to subscriber's age.

Subscribers under the APY scheme must enable auto-debit facility for making monthly contributions. Individual or manual contribution is not available. In case of delay of payments, a nominal charge may apply.

After completion of 5 years, The Government of India will co-credit an amount of 50% of yearly contribution or maximum Rs 1000 per annum. This Government co-credit benefit is available only for those who are not covered by any other Statutory Social Security Schemes or do not pay income tax.

APY Monthly Contribution Chart

| Minimum Monthly Pension | |||||

| Age of Entry | Rs.1000 | Rs.2000 | Rs.3000 | Rs.4000 | Rs.5000 |

| 18 | 42 | 84 | 126 | 168 | 210 |

| 19 | 46 | 92 | 138 | 183 | 228 |

| 20 | 50 | 100 | 150 | 198 | 248 |

| 21 | 54 | 108 | 162 | 215 | 269 |

| 22 | 59 | 117 | 177 | 234 | 292 |

| 23 | 64 | 127 | 192 | 254 | 318 |

| 24 | 70 | 139 | 208 | 277 | 346 |

| 25 | 76 | 151 | 226 | 301 | 376 |

| 26 | 82 | 164 | 246 | 327 | 409 |

| 27 | 90 | 178 | 268 | 356 | 446 |

| 28 | 97 | 194 | 292 | 388 | 485 |

| 29 | 106 | 212 | 318 | 423 | 529 |

| 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 126 | 252 | 379 | 504 | 630 |

| 32 | 138 | 276 | 414 | 551 | 689 |

| 33 | 151 | 302 | 453 | 602 | 752 |

| 34 | 165 | 330 | 495 | 659 | 824 |

| 35 | 181 | 362 | 543 | 722 | 902 |

| 36 | 198 | 396 | 594 | 792 | 990 |

| 37 | 218 | 436 | 654 | 870 | 1087 |

| 38 | 240 | 480 | 720 | 957 | 1196 |

| 39 | 264 | 528 | 792 | 1054 | 1318 |

| 40 | 291 | 582 | 873 | 1164 | 1454 |

Penalty for Discontinue and Delay in Payments

In case of delay in making monthly contributions in Atal Pension Yojana, subscribers need to pay additional penalty charges along with the future contribution. Though the monthly installment is auto-debited from the bank account on a particular date of a month, so subscribers must have to maintain an adequate amount of account balance to avoid miss-payment. Here is the table for penalty charges:

| Penalty Charge | Monthly Contribution Range |

| Rs.1 | Upto Rs.100 p/month |

| Rs.2 | Upto Rs.101-500 p/month |

| Rs.5 | Upto Rs.501-1000 p/month |

| Rs.10 | Above Rs.1000 p/month |

Because of any reason, if the monthly contributions are stopped for a long time, then the following rules will apply:

- If you don’t contribute for a long period of above 6 months, then the APY account will be frozen.

- The account will be deactivated in case of non-payment above 12 months.

- The account will be closed in case of non-payment above 24 months and the accumulated balance will be refunded back to the linked savings account.

Spouse adding facility under APY scheme

APY allows adding spouse with the subscribers. That means, in case of death of the subscriber, the pension will be continued to his/ her spouse. Spouse adding is not mandatory. But if anyone needs to add or change spouse, it is possible. To do so, the subscriber needs to submit the written request with supportive documents to the bank or the Post Office branch.

In case of death of the subscriber before attaining the age of 60 years, the spouse will be designated as a nominee by default. So, he/ she can exit from the scheme and get the payments. However, the person even can continue the account by making farther contributions.

Nomination facility under Atal Pension Yojana (APY) scheme

It is mandatory to have a nominee for an APY account. In order to nominate a person, a subscriber needs to mention nominee details into the subscription or account opening form. However, a nominee can be added or changed after the account opening. To add or change the nominee, the subscriber needs to visit the branch and submit a written request for the same. In case of death of the subscriber before attaining the age of 60 years, the nominee will receive the accumulated balance of the APY account.

Income Tax benefits

The APY subscribers can get a tax deduction up to Rs. 50,000 with 80CCD (1B), but only after claiming Rs. 1.5 lakh under section 80C Income Tax Act.

Premature closure, maturity, pension and withdrawal rules

The subscriber of Atal Pension Yojana (APY) must continue to invest till the age of 60 years. However, with some exceptional conditions, a subscriber can close or make withdrawals.

- Before maturity:

- If the APY subscriber wants to withdrawal before attaining the age of 60 years, initially is not permitted. However, withdrawal is approved only critical illness or death of the subscriber.

- APY allows voluntary exit from the scheme. If the subscriber wants to exit from the scheme, he/ she needs to request for this same to the bank or post office. In this case, after deducting all charges, the only corpus contributed by the subscriber will be refunded to the subscriber's savings account. On pre-mature exit, Government co-credit contributions will not be paid.

- After maturity: After maturity, subscribers have to buy 100% annuity for future pensions. The partial or full withdrawal is not allowed in this scheme.

- In case of death of the subscriber:

- Before attaining the age of 60 years: If the spouse wishes to close the account in case of death of the subscriber, the spouse can either withdraw the total accumulated corpus or continue to contribute for remaining times.

- After attaining the age of 60 years: After age completion of 60 years, the subscriber will be received the pre-defined pension per month. In case of death the primary subscriber, the spouse (if any) will continue to receive the same pension for entire life. After the death of the subscriber and his/ her spouse, the corpus will be paid to the nominee.

Benefits of APY

The Atal Pension Yojana (APY) is a pension scheme ideal for people who works in the unorganized sector.

Guaranteed pension: APY promises a guaranteed pension after the age of 60 years. The pension amount declared from the minimum Rs.1000, Rs.2000, Rs.3000, Rs.4000, and Rs.5000.

Spouse and Nominee: Spouse adding facility is a core benefit of this scheme. After the death of the primary subscriber, his/ her spouse is eligible to receive the full pension for lifespan. After the death of the subscriber before maturity, the spouse can maintain the account to get future pensions. The nominee gets the corpus after the demise of both the account subscriber and the spouse.

Tax benefits: Atal Pension Yojana offers an income-tax deduction of Rs. 50,000 under section 80CCD (1B).

Some drawbacks of APY scheme

- The age of opening an Atal Pension Yojana (APY) must between 18 to 40 years. Above 40 years of age, no one can apply for this scheme.

- The pension amount not so attractive. With the increasing rate of inflation, after a couple of years, the pension amount may not be helpful to survive.

- After maturity or age of 60 years, subscribers cannot withdrawal the accumulated corpus. The only option is to get monthly pensions.

- Penalty or charges for delay in contributions and non-account maintenance are not completely clear.

- APY scheme is not declared that either the premature withdrawals are taxable or tax-free.

Frequently asked questions

Can I subscribe to the APY scheme without having a savings account?

No, without have savings account an APY account can not be opened.

Is it mandatory to add nominee details in the APY account?

Yes, it is mandatory.

How many APY accounts I can open?

An individual can open a single APY account.

Can the spouse open a separate APY account?

Yes, spouse linked with an existing APY account can also open a separate APY account for himself/ herself.

Can I increase or decrease the monthly contribution amount for getting the higher or lower pension amount?

Yes, the scheme permits the subscriber to increase or decrease the pension amount. The subscriber can change his/her desire amount only once per annum.

How will I know the status of APY contribution?

The information about PRAN, contributions, and account balance will be notified through your registered mobile number by sending SMS alerts and also received a physical financial year statement one time per year at your registered address.

Can a minor open APY account?

No, a minor is not eligible for opening the APY account.

Can I withdrawal 100% corpus in the case of superannuation or premature death?

Yes, an individual can withdraw 100% corpus in the following cases:

After superannuation a subscriber can demand 100% withdrawal if his/her total accumulated corpus is not greater than 2 lakh or equal.

In case of premature exit, if the subscriber's accumulated corpus is not greater than 1 lakh, the subscriber must continue the contributions. Before completing 10 years cannot exit from the scheme.